Form 1042-S

IRS Form 1042-S is the Foreign Person’s U.S. Source Income Subject to Withholding form. This form is used to report the amount of income received on your behalf by your booking agent or management company. The form is prepared by the management company or withholding agent, submitted to the IRS and copied to the rental […]

Form W-8BEN-E

Form W-8BEN-E is the Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) form. This form is used by foreign entities to document their status for purposes of chapter 3 and chapter 4, as well as other code provisions.

Form W-8ECI

Form W-8ECI is the Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected with the Conduct of a Trade or Business in the United States Generally, a foreign person is subject to U.S. tax on its U.S. source income. Most types of U.S. source income received by a foreign person are […]

IRS Form 5472: New Information Reporting for Foreign-Owned U.S. Disregarded Entities

If you’re an individual foreign investor who purchased or transferred your U.S. asset through a single member entity/disregarded entity as described below, you may have an additional filing requirement for the 2017 tax year. The U.S. Treasury Department and Internal Revenue Service (IRS) information reporting applies to U.S. disregarded entities (such as single-member LLCs, revocable […]

Form 1099-S

When you sell your home, federal tax law requires lenders or real estate agents to file a Form 1099-S, Proceeds from Real Estate Transactions, with the IRS and send you a copy if you do not meet IRS requirements for excluding the taxable gain from the sale on your income tax return. To avoid violating […]

US Tax Compliance – US or Foreign Entity

Listed below are the primary taxation and compliance issues for US rental property(ies) held by a U.S. or Foreign LLC, Partnership or Corporation. Please note: the information and filing deadlines provided below for Tangible Personal Property Tax, Property or Real Estate Tax, Hotel License and Local Business Tax are specific to the State of Florida. […]

Section 199A – Qualified Business Income Deduction (QBID)

Qualified Business Income Deduction (QBID) – Rental Enterprise The Tax Cuts and Jobs Act of 2017 (TCJA) provides the most significant tax legislation changes in the United States for the last 30 years. Due to the nature & quantity of the tax changes, the IRS continues to provide final guidance on matters into 2019. The […]

Non Resident Individual US Tax Compliance

Listed below are the primary taxation and compliance issues of which a non-resident owner of U.S. rental property should be aware. Please note: the information and filing deadlines provided below for Tangible Personal Property Tax, Property or Real Estate Tax, Hotel License and Local Business Tax are specific to the State of Florida. Please contact […]

Individuals Filing the Report of Foreign Bank and Financial Accounts (FBAR)

FBAR is required to be filed by U.S. citizens, permanent residents (green card holders) and resident aliens who own or had authority over a foreign (non U.S.) financial account, including a bank account and the combined value of the accounts exceeded $10,000 at any time during the calendar year. Penalties for non filing are significant. […]

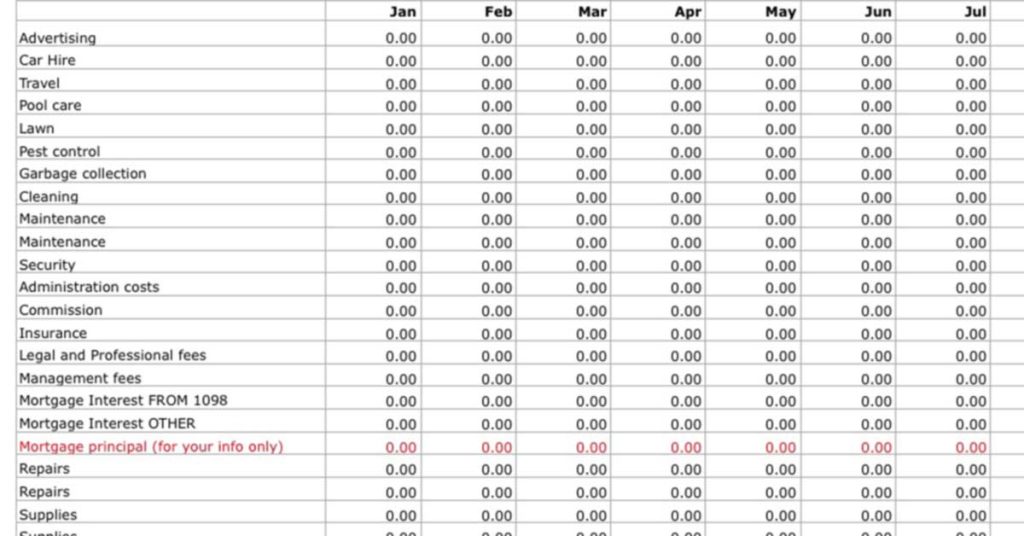

HBI Income & Expense Spreadsheet and Questionnaire Video Tutorials

Welcome to our video guide series where you will find information and assistance on categories such as completing our annual non-resident tax questionnaire, categorization of property expenses and travel pro-ration. Completing the HBI Annual Questionnaire Current Expenses v Capital Purchases Travel Cost Proration Travel to and from the United States

HBI Income & Expense Spreadsheet and Questionnaire

For your convenience, in the “Downloadable Forms” section below we’ve provided MS Excel spreadsheets to assist in recording the income and expenses on your rental properties and the preparation of your annual U.S. Income Tax Returns. Important Note: Please select the appropriate file below and then select SAVE AS (not OPEN) to save the file to […]

List of Common IRS Forms for Foreign Investors in the US

Foreign Investor Income Withholding Forms Other Forms